To check your journey insurance policy limits, start by reviewing your policy documents for maximum payout amounts and any sub-limits. Look for details on key coverage areas like trip cancellation and medical expenses. If you need clarification, don't hesitate to contact your insurance provider directly using their customer service number or your online account portal. Prepare your policy number and specific questions to facilitate a smoother process. Regularly evaluating your coverage in relation to your travel needs is essential. There's more to discover about adjusting your limits and guaranteeing you have the right protection for your trips.

Key Takeaways

- Review your policy documents to identify maximum payout amounts for medical expenses, trip cancellations, and baggage loss coverage.

- Understand the distinction between per occurrence limits and aggregate limits for different types of claims.

- Check for any exclusions or sub-limits in coverage that may affect your overall protection.

- Contact your insurance provider for clarification on policy terms and specific coverage details.

- Regularly assess your travel needs and adjust coverage limits based on destination risks and trip duration.

Understanding Insurance Policy Limits

When it comes to insurance, how well do you understand your policy limits? Understanding your insurance policy limits is essential for guaranteeing you have adequate protection. These limits define the maximum payout your insurer will provide for covered losses, which can vary considerably depending on your policy type and provider.

It's important to recognize that limits can be categorized into per occurrence limits, which is the maximum payout for a single claim, and aggregate limits, which are the total payout limits for all claims during a policy period. Additionally, be aware of sub-limits that may apply to specific types of coverage, such as personal belongings. These sub-limits can impact the total amount available for your claims.

Not reviewing your coverage limits regularly can lead to considerable out-of-pocket expenses if a claim arises. As your personal circumstances or asset values change, it's essential to conduct a coverage review to guarantee your limits align with your current needs. By understanding your insurance policy limits, you can confidently navigate claims and protect yourself from unexpected financial burdens.

Reviewing Your Policy Documents

Reviewing your policy documents is essential for understanding your journey insurance coverage. These documents outline critical details about your policy limits, helping you know what to expect in case you need to file claims. To effectively review your policy, focus on the following key areas:

- Limits: Check for maximum payout amounts for different claims, including medical expenses and baggage loss.

- Exclusions: Identify any specific exclusions that could affect your coverage. Certain events or conditions may not be covered, which can impact your overall protection.

- Sub-limits: Look for any sub-limits that apply to particular types of coverage, as these can vary and potentially limit your claims.

Additionally, pay attention to definitions like "per occurrence" and "aggregate limits." These terms dictate how much the insurer will pay for individual claims versus total claims over the policy period. If you find any confusing terms or details, don't hesitate to reach out to your insurance provider for clarification. A thorough review guarantees you're well-informed and prepared for your travel adventures.

Contacting Your Insurance Provider

To check your journey insurance policy limits, it's best to contact your insurance provider directly. You can reach out via their customer service number or use online chat for immediate assistance. Before you do, make certain you have your policy number and personal details ready. This preparation will help guarantee a smoother and quicker inquiry about your coverage limits.

Many insurance providers also offer an online account portal where you can log in to view your policy details, including coverage limits and exclusions. If you prefer this method, it can save you time and provide the information you need at your convenience.

When you connect with customer service, be prepared to ask specific questions about per occurrence and aggregate limits. This clarity will help you fully understand the scope of your coverage. If you have multiple policies, clarify which specific policy you're inquiring about to receive accurate information regarding the correct limits. By taking these steps, you'll have an extensive understanding of your journey insurance coverage and limits, guaranteeing you're well-prepared for your travels.

Comparing Coverage With Travel Plans

Understanding your journey insurance policy limits is important, but it's equally essential to compare those limits with your travel plans. By doing this, you can ascertain you're adequately protected against unexpected costs. Here are some key aspects to contemplate:

- Coverage Limits: Review the specific maximum payouts for incident types like trip cancellation and medical expenses. Make sure these align with your potential expenses.

- Overall Trip Cost: Assess your total trip expenses, including non-refundable travel costs. This helps gauge whether your travel insurance policy provides sufficient coverage limits.

- Exclusions and High-Risk Activities: Be aware of exclusions in your policy, especially for high-risk activities. If your trip includes such activities, you may need higher coverage limits.

Additionally, reflect that the insurance premium typically ranges from 4% to 10% of your overall trip cost. This can influence your choice of coverage limits, so find a balance between affordability and adequate protection. By carefully comparing your travel plans with your insurance policy, you'll better safeguard your investment and enjoy peace of mind during your journey.

Key Coverage Types to Check

When planning your trip, it's crucial to pay attention to the key coverage types in your journey insurance policy. First, check the Trip Cancellation Coverage; it should specify the maximum reimbursement for non-refundable expenses if you need to cancel your trip. This typically ranges from $10,000 to $100,000 based on your insurer and plan.

Next, examine the Medical Expense Limits. Policies can vary widely, with coverage often between $10,000 and $8 million for medical care while you're away. Don't forget to verify the Emergency Medical Evacuation limits, especially if you're traveling to remote areas; some policies cover expenses up to $1 million or more.

Baggage Loss Coverage is another important area to assess. Look for maximum payouts for lost, damaged, or stolen luggage, which usually range from $500 to $2,500 per person. Finally, review the Trip Interruption Coverage, which compensates for non-refundable costs if your trip gets cut short, typically covering amounts from $1,500 to $20,000. Understanding these coverage limits can make a significant difference in protecting your investment and peace of mind while traveling.

Common Exclusions and Limitations

Many travel insurance policies come with common exclusions and limitations that can catch you off guard if you're not aware of them. Here are a few essential points to keep in mind:

- Pandemic Coverage: Many policies exclude coverage for epidemics and pandemics, meaning illnesses like COVID-19 may not be covered under standard plans.

- Trip Cancellation: Policies often have exclusions for reasons not explicitly listed, such as personal dissatisfaction or changes in travel plans unrelated to covered events.

- Pre-existing Conditions: Coverage limitations often apply to pre-existing conditions, requiring you to purchase additional coverage within a specified timeframe, like 14 days of your trip deposit.

Moreover, understanding deductibles is important, as you'll need to pay a certain amount out-of-pocket before your insurance kicks in. Be cautious with high-value items too; some policies may impose sub-limits, which can result in reduced reimbursement for lost or stolen possessions. By familiarizing yourself with these common exclusions and limitations, you'll be better prepared to select the right travel insurance that meets your needs.

Adjusting Your Policy Limits

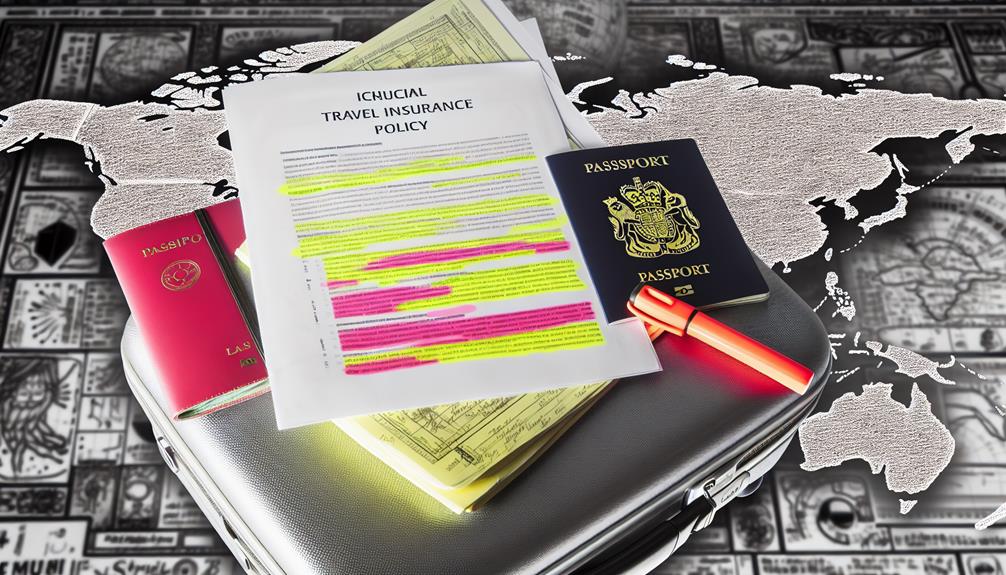

Having a grasp on common exclusions and limitations is a great start, but it's just as important to confirm your coverage limits are tailored to your specific travel needs. Begin by reviewing your insurance policy document to pinpoint the stated policy limits for claims like trip cancellation and medical expenses. Understanding per occurrence limits versus aggregate limits helps you know how much coverage you truly have.

As you plan your trips, regularly assess your travel needs. Consider factors such as destination healthcare costs, trip duration, and personal health risks. If you find that your current policy limits are insufficient, don't hesitate to consult your insurance agent. They can help you adjust limits to confirm you're adequately covered, especially after significant life events that may affect your insurance needs.

Periodically, it's wise to compare options in the market. This confirms you're not underinsured or overpaying for coverage. By taking these steps, you'll have peace of mind knowing your policy limits align with your travel requirements, protecting you against unexpected expenses along the way.

Frequently Asked Questions

What Is the Maximum Limit for Travel Insurance?

The maximum limit for travel insurance usually ranges from $10,000 to $8 million, depending on the policy and provider you choose. Extensive plans often cover all eligible expenses during your trip, but limits can vary for specific coverage types like medical expenses or trip cancellation. While higher limits offer better protection in emergencies, they also come with increased premiums. So, consider your destination's healthcare costs and your personal health needs when selecting a policy.

Where Would You Find the Limits in the Insurance Contract?

You'll find the limits in your insurance contract by checking the "Coverage" or "Benefits" section. Look for headings like "Policy Maximums" or "Coverage Limits" for details on each type of coverage. The declarations page at the beginning offers a quick summary of these limits. Additionally, review the specific sub-sections for any sub-limits, like those for baggage loss or trip cancellation, as these can affect your overall coverage.

What Is the Insurance Coverage Limit?

The insurance coverage limit is the maximum amount your insurer will pay for a covered loss under your policy. It varies by insurance type and can be structured as per occurrence or aggregate limits. For example, travel insurance limits typically range from $10,000 to $8 million. Understanding these limits is essential, as they determine how much financial protection you have when facing potential claims, ensuring you don't face significant losses.

What Is the Coverage Limit of an Insurance Policy Is?

The coverage limit of an insurance policy is the maximum amount your insurer will pay for a covered loss. It's specified in your policy agreement and can vary widely based on the type of insurance. For instance, travel insurance limits can range from $10,000 to $8 million. Understanding these limits, including any sub-limits for specific coverage types, is essential to know how much protection you really have. So, always review them carefully.