To compare journey insurance policies, start by understanding the types available, like single trip or annual coverage. Focus on key details such as trip cancellation limits, emergency medical coverage, and luggage protection amounts. Use online comparison tools to view policies side-by-side, and gather your trip specifics for accurate quotes. Don't forget to check customer reviews for insights on claims processing and provider reputation. Finally, pay attention to policy exclusions to avoid surprises. With these steps, you'll be well-equipped to choose the best policy for your adventures—and there's more to discover.

Key Takeaways

- Use comparison tools to view multiple journey insurance policies side-by-side for easier evaluation of coverage and costs.

- Gather essential trip details, such as destination and duration, to obtain tailored quotes from insurers.

- Review key coverage features, including trip cancellation and emergency medical coverage, to ensure adequate protection for your needs.

- Check suggested coverage amounts, like $50,000+ for medical emergencies, to ensure sufficient financial security during your journey.

- Pay close attention to exclusions and limitations in policies, particularly regarding pre-existing conditions and high-risk activities.

Understanding Travel Insurance Types

When planning your next trip, it's vital to understand the different types of travel insurance available to you. Knowing the various travel insurance policies can help you choose the right coverage for your specific needs. For instance, if you're going on a one-time vacation, a Standard Single Trip Policy may be perfect, as it covers cancellations, medical emergencies, delays, and luggage issues.

If you travel frequently, consider an Annual/Multi Trip Policy, which is a cost-effective choice that covers multiple trips in a year. Cruise Insurance Policies specifically cater to travelers heading out on ocean voyages, addressing risks like trip cancellations and onboard medical emergencies.

For adventure seekers, Adventure & Sports Policies offer tailored coverage for high-risk activities. Finally, if you're venturing abroad, Emergency Evacuation coverage is essential, as it can save you from hefty costs associated with emergency medical evacuations, ideally with a coverage amount of $100,000 or more.

Key Coverage Details to Consider

Choosing the right travel insurance policy involves more than just understanding the types available; it's also about knowing the key coverage details that can make or break your trip. Here are some essential coverage aspects to evaluate:

| Coverage Type | Recommended Amount | Importance |

|---|---|---|

| Trip Cancellation Coverage | 100% of trip cost | Reimburses non-refundable expenses |

| Emergency Medical Coverage | $50,000+ per traveler | Covers unexpected health issues abroad |

| Trip Delay Protection | $1,000+ per traveler | Covers additional expenses due to delays |

| Luggage Protection | $500+ per traveler | Mitigates financial impact of lost/delayed baggage |

| Cancel for Any Reason (CFAR) | Up to 75% of trip cost | Offers flexibility for non-covered cancellations |

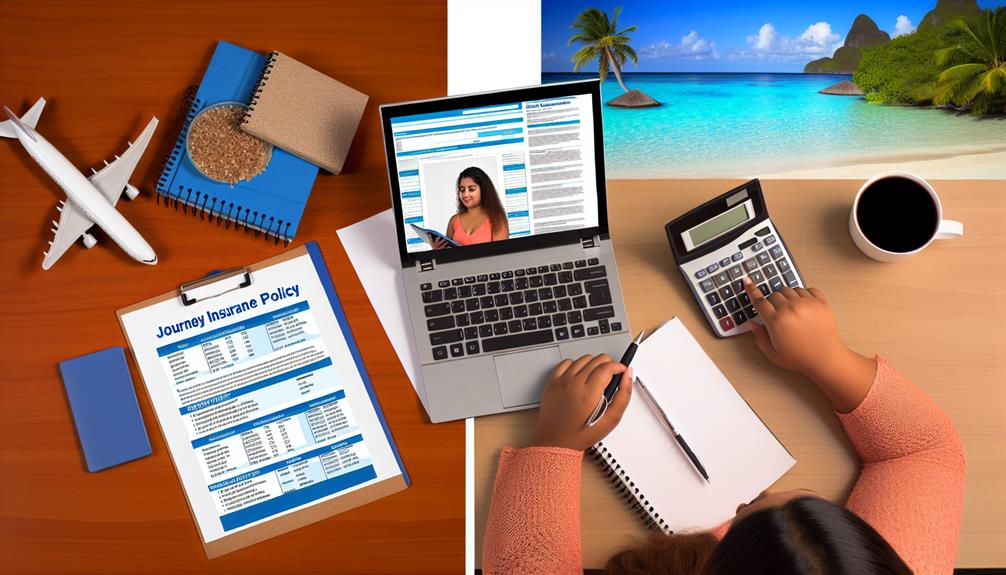

Effective Comparison Techniques

Steering through the world of travel insurance can feel overwhelming, but using effective comparison techniques can simplify the process. Start by utilizing comparison tools that let you view multiple travel insurance policies side-by-side. This way, you can easily compare coverage options and pricing from different providers, making your decision clearer.

Before diving in, gather basic trip details like your destination, trip duration, and traveler age. This information helps you receive personalized quotes tailored to your specific needs. As you review policies, look for key coverage features such as trip cancellation, emergency medical coverage, and luggage protection. Make sure to check suggested coverage amounts for adequate financial protection.

Don't overlook the fine print; pay attention to exclusions and limitations in each policy, especially regarding pre-existing conditions and specific events that may not be covered. By doing this, you'll get a clearer picture of what's offered. Overall, these effective comparison techniques will empower you to choose the right travel insurance for your journey while ensuring you're well-protected.

Evaluating Customer Reviews

Customer reviews serve as a crucial resource for evaluating travel insurance providers and their policies. With over 150,000 reviews available, you can gain insights into the reliability and performance of different companies, enhancing transparency and trust. Here's what to look for:

- Claims Processing: How efficiently does the provider handle claims?

- Customer Service: Are they responsive and helpful when you need assistance?

- Policy Satisfaction: Do customers feel their policies met their expectations?

A high recommendation rate of over 99% indicates strong customer satisfaction and confidence in the services offered. By evaluating reviews, you can identify common themes around claims processing and overall policy satisfaction, which helps you make informed decisions.

Pay particular attention to detailed reviews that share specific experiences, especially regarding claims for trip cancellations or medical emergencies. These insights shed light on how well a company handles real-life situations. Additionally, many review platforms offer ratings and comparisons of various insurance plans, allowing you to pinpoint which policies best meet your needs based on genuine customer feedback.

Important Policy Exclusions

Understanding important policy exclusions is crucial when selecting travel insurance. Many policies exclude coverage for pre-existing medical conditions unless you purchase a waiver within a specific timeframe, usually 14-21 days after your trip deposit. If you know about a potential issue before buying the policy, you might find yourself without coverage for cancellations resulting from those known events.

Additionally, be cautious of exclusions related to high-risk activities or sports. If your travel plans include adventurous pursuits, confirm your policy covers those activities to avoid surprises.

When it comes to coverage for personal belongings, recognize that many plans impose limits on high-value items. Electronics and jewelry are often excluded or restricted to a certain amount, so you may need additional coverage for those valuables.

Lastly, understand that losses due to government travel advisories or acts of terrorism might not be covered unless explicitly stated in your policy. Always read the fine print and clarify any uncertainties with your provider. By grasping these policy exclusions, you can better protect yourself and make informed decisions about your travel insurance.

Purchasing Options and Support

Maneuvering the world of journey insurance can feel overwhelming, but knowing your purchasing options can simplify the process. You've got a variety of paths to choose from when buying your policy:

- Direct Providers: Get quotes straight from insurance companies.

- Comparison Sites: Easily view multiple plans side-by-side.

- Travel Suppliers: Consider options from airlines or travel agencies.

When you're ready to get quotes, simply input basic trip details, and you'll receive personalized options quickly. Using a comparison site can be particularly beneficial, as these platforms often feature user-friendly interfaces that allow you to assess plans from top providers at a glance. It's advisable to compare at least 3-5 options to guarantee you find the best policy tailored to your travel needs and budget.

Don't forget about customer support! Most providers offer direct links, phone numbers, and email assistance, guaranteeing you get the personalized help you need throughout the purchasing process. With the right resources and support, you can confidently navigate your journey insurance options and secure a policy that protects your travels.

Finalizing Your Insurance Choice

As you approach the final stages of selecting your journey insurance, it's vital to compare coverage limits and exclusions across various policies to guarantee your travel needs are fully met. Use comparison tools that provide side-by-side views of multiple plans. This will help you easily identify the best value based on your budget and specific coverage requirements.

Don't forget to take into account the reputation of the insurance providers. Over 99% of customers recommend top-rated companies for their reliability and service quality. Positive customer reviews can guide you toward making a sound decision.

Also, pay attention to additional benefits like 24/7 emergency assistance. This support can be important during unexpected situations while you're traveling.

Frequently Asked Questions

What Is the Best Travel Insurance to Buy?

The best travel insurance to buy depends on your needs. Look for a policy with thorough trip cancellation coverage that reimburses 100% of prepaid expenses. Make sure it includes emergency medical coverage of at least $50,000 and consider options like Cancel for Any Reason for added flexibility. Don't forget to check if it offers emergency evacuation benefits, ideally around $100,000, to protect you from unexpected costs while traveling. Always compare multiple plans before deciding.

Does Travel Insurance Get More Expensive Closer to the Trip?

Yes, travel insurance does get more expensive as your trip date approaches. Insurers see last-minute bookings as higher risk, leading to increased premiums. If you wait to buy your policy, you might pay 10-20% more if it's less than 14 days before your departure. To save money and secure better coverage, it's smart to purchase your travel insurance soon after booking your trip, giving you time to compare options effectively.

Where Can I Get the Best Travel Insurance?

You can find the best travel insurance by exploring platforms like InsureMyTrip, which offers a user-friendly comparison engine. By entering your trip details, you'll receive tailored quotes in minutes, helping you identify policies that fit your budget and coverage needs. With over 20 years of experience and access to top-rated providers, you can rest assured you're getting high-quality options. Plus, licensed agents are available to guide you through the purchasing process.

Is AIG or Allianz Travel Insurance Better?

When deciding whether AIG or Allianz travel insurance is better, consider your specific needs. Allianz has a strong reputation and high customer satisfaction, which might give you peace of mind. However, AIG offers unique features like Cancel for Any Reason options that could be beneficial. Look into the coverage limits, exclusions, and pricing for both. Ultimately, it's about finding the policy that aligns best with your travel plans and preferences.